For people who want to retire, there are some things that must be considered. These include the places where you want to live and retire. Basically, you do not simply pick a place that you want and live there. There are some factors that you still need to consider before you choose a best place to retire for you.

Relocation is probably the biggest issue for retirees whether they have a fixed income or not. Usually, they are concern about how their retirement income will be taxed. They are also considering if the food is also taxed on a specific place. It is better if you will consider no income tax states.

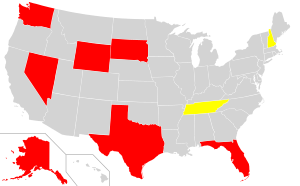

If you will consider some of the no income tax states, Alaska is probably at the top of your list. Actually, this place even pays for the people who want to live there. There is no state income tax, no state sales tax and it only has 25 places that have a property tax. In 2009, the dividend given for people who resides in Alaska for at least one year is $1,305 for every man, woman and child in your family. This is probably the best place that you can live when you talk about taxes. However, if you are already too old and you cannot withstand too much cold, it is not advisable for you to live here since this is one of the coldest places on Earth. The no income tax can be good for a retiree but the place is not a good residential area for older people.

Florida also has no individual income tax but it has a corporate income tax of about 5 percent. The state previously had a tax on “intangible personal property” but it was removed in the year 2007. You all know that Nevada is a gambling state. Las Vegas is here so gambling is very much in demand. Nevada does not have individual or corporate income tax. This is mainly because most of its revenue comes from gambling and sales taxes. This is also one of the best places to retire when you talk about taxes and there are a lot of places that you can visit here.

South Dakota does not also have individual income tax but it has a state corporate income tax that is implemented on different financial institutions. You can also consider Tennessee on your list. They only get taxes from income received from stocks and bonds. This is also the case with New Hampshire. You can also consider Washington. It has no individual tax but if you are planning to put up a business, you will have to pay for business tax. They also have occupation taxes based on gross receipts.

Wyoming and Texas round out the no income tax states.

If you to have a list of some of the best states to retire with low taxes, you can look to Wyoming, Pennsylvania, Delaware, Colorado, Michigan, Georgia, Alabama and South Carolina. Like what is said earlier, the climate is also a determining factor and not only the tax implemented on the state but the tax of a specific place can also be a factor when you are looking for the best state to reside.

It will still depend on your preference where you want to live. If you do not want individual taxes, there are specific places that you can consider. However, you will also have to look at the other taxes that they implement on the state. If you are planning to work or put up a business during your retirement years, it is better to look for a state where there are not implemented business or occupation taxes. It can be a big help to your finances.